Criminals in some cases prey on SDIRA holders; encouraging them to open accounts for the goal of producing fraudulent investments. They often fool investors by telling them that When the investment is approved by a self-directed IRA custodian, it must be genuine, which isn’t correct. Again, Ensure that you do complete homework on all investments you end up picking.

Constrained Liquidity: Most of the alternative assets that could be held in an SDIRA, for example real-estate, private fairness, or precious metals, will not be quickly liquidated. This can be an issue if you should access funds promptly.

Opening an SDIRA can present you with use of investments Typically unavailable via a financial institution or brokerage business. In this article’s how to begin:

As you’ve discovered an SDIRA provider and opened your account, you may be asking yourself how to actually commence investing. Comprehension equally The principles that govern SDIRAs, in addition to the way to fund your account, can assist to lay the muse for your future of successful investing.

Though there are numerous Added benefits related to an SDIRA, it’s not with no its possess negatives. A lot of the prevalent main reasons why traders don’t pick out SDIRAs consist of:

Relocating cash from just one style of account to another type of account, like shifting funds from the 401(k) to a standard IRA.

Be accountable for the way you expand your retirement portfolio by utilizing your specialized understanding and pursuits to speculate in assets that healthy along with your values. Acquired knowledge in property or personal fairness? Use it to assist your retirement planning.

Number of Investment Options: Make sure the company lets the categories of alternative investments you’re enthusiastic about, for instance real estate this website property, precious metals, or private fairness.

And since some SDIRAs like self-directed common IRAs are topic to expected minimal distributions (RMDs), you’ll ought to plan ahead making sure that you've adequate liquidity to satisfy The principles set because of the IRS.

Put simply just, should you’re looking for a tax effective way to build a portfolio that’s additional tailor-made on your interests and abilities, an SDIRA may be The solution.

Bigger investment options indicates it is possible to diversify your portfolio outside of shares, bonds, and mutual money and hedge your portfolio from industry fluctuations and volatility.

As an investor, having said that, your options usually are not restricted to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Research: It is identified as "self-directed" to get a motive. With the SDIRA, you will be entirely to blame for completely exploring and vetting investments.

This includes comprehension IRS regulations, taking care of investments, and avoiding prohibited transactions that can disqualify your IRA. A scarcity of data could bring about pricey blunders.

In case you’re hunting for a ‘set and overlook’ investing method, an SDIRA almost certainly isn’t the ideal decision. As you are in total Management around each and every investment designed, it's up to you to carry out your very own homework. Try to remember, SDIRA custodians aren't fiduciaries and cannot make recommendations about investments.

No, You can't put money into your own personal organization that has a self-directed IRA. The IRS prohibits any transactions amongst your IRA plus your very own business enterprise since you, as being the operator, are regarded as a disqualified man or woman.

Certainly, real estate is one of our customers’ hottest investments, at times named a real estate property IRA. Purchasers have the option to invest in every thing from rental Qualities, commercial property, undeveloped land, mortgage loan notes plus much more.

The most crucial SDIRA guidelines from your IRS that traders will need to be familiar with are investment restrictions, disqualified persons, and prohibited transactions. Account holders should abide by SDIRA principles and rules so as to maintain the tax-advantaged position of their account.

From time to time, the costs related to click to read SDIRAs is usually increased and much more complicated than with an everyday IRA. This is because with the elevated complexity affiliated with administering the account.

Tia Carrere Then & Now!

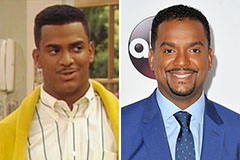

Tia Carrere Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!